Copper is the first metal discovered and used by human beings, and it plays an important role in the national economy and modern life. As the world’s largest copper consumer, China’s copper resources are relatively poor. The latest data from the United States Geological Survey (USGS) shows that by the end of 2022, the global copper resource reserves are 890 million tons, and China accounts for only 3%. Countries rich in copper resources in the world mainly include Chile, Australia, Peru, Russia, Mexico and the United States. Although China’s copper resource reserves rank among the top in the world, compared to its copper consumption, copper resource reserves are still relatively low.

Undoubtedly, global copper mine production is mainly distributed in copper-rich countries. For copper smelting production capacity, considering the optimal allocation of resources, it is more scientific and reasonable economically to build factories in countries rich in copper resources and in countries and regions with concentrated copper consumption.

The following is a brief analysis of the current status and development trends of global copper mines and copper smelting (rough refining) production capacity.

Global Copper Mine and Smelting Capacity Status

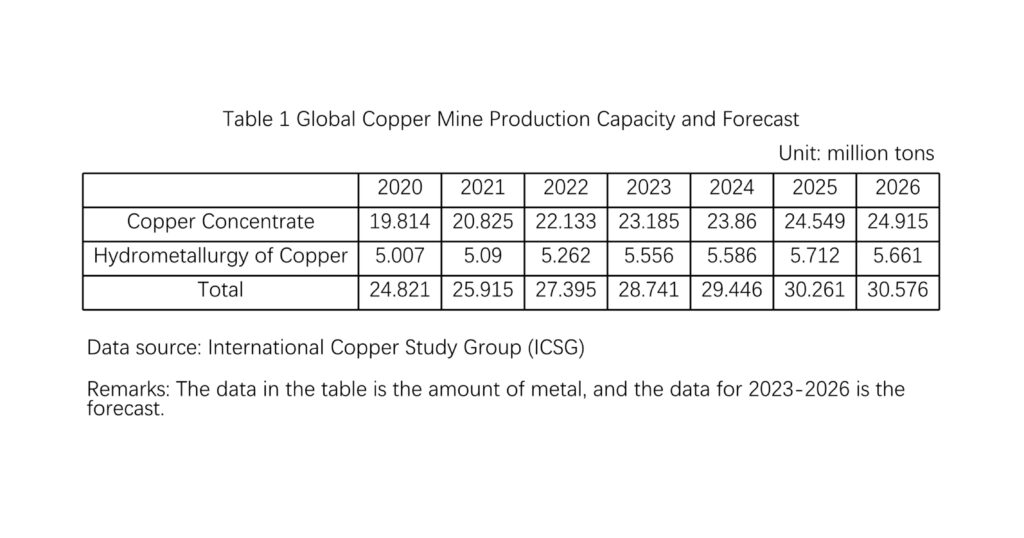

According to data from the International Copper Study Group (ICSG), there are currently 840 copper mines (including operations and planned development), 165 rough refineries and 325 refineries in the world. By the end of 2022, the global copper mine production capacity will be 27.395 million tons, of which the copper concentrate production capacity will be 22.133 million tons and the hydrometallurgy (SX-EW) production capacity will be 5.262 million tons. (See Table 1)

Through the analysis of the data in Table 1, it can be concluded that from 2020 to 2026, the average annual compound growth rate of global copper mine production capacity will be 3.5%. Among them, the compound annual growth rate of copper concentrate is 3.9%, and the compound annual growth rate of wet copper is 2.1%. In terms of distribution regions, in 2022, South America will have the largest copper production capacity, exceeding 10 million tons, accounting for 35.1% of the world; Asian copper production capacity is 5.37 million tons, accounting for 18.7% of the world; Africa and North America accounted for 15.3% and 14.2% respectively. South American copper mine production capacity is mainly concentrated in Chile and Peru, whose copper mine production capacity is 6.57 million tons and 2.92 million tons respectively; Asian copper mine production capacity is mainly concentrated in China, Indonesia, Kazakhstan, Iran and Mongolia, etc.; African copper mine production capacity mainly concentrated in DR Congo and Zambia, their copper mine production capacity totals 4.08 million tons, accounting for 92.7% of Africa’s copper mine production capacity.

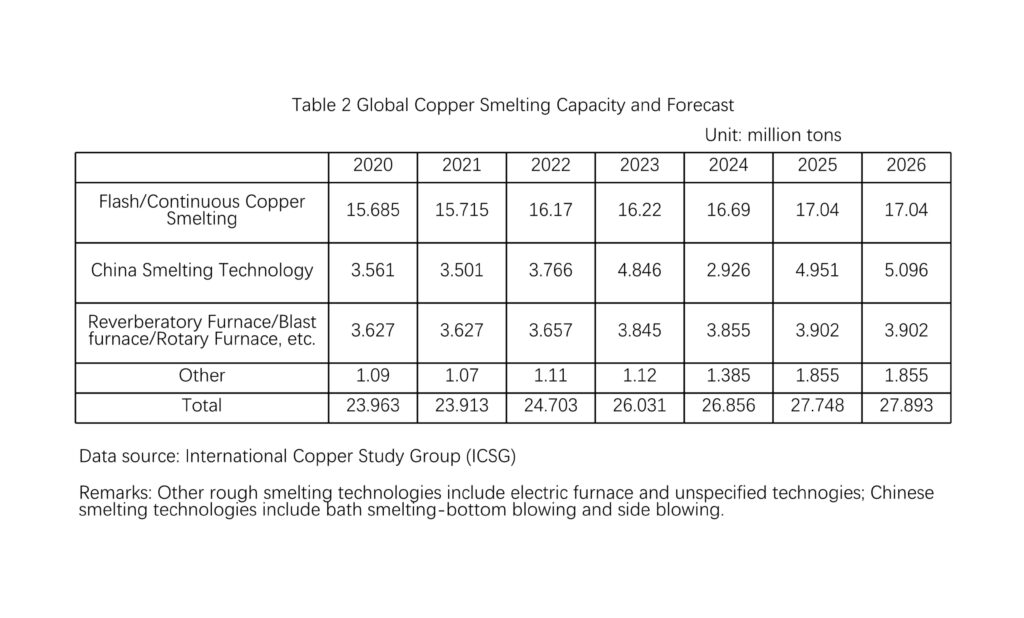

From the perspective of copper mine production capacity, the world’s top 20 copper mines have a total production capacity of 9.56 million tons, accounting for 34.9% of the world’s total copper mine production capacity. Among them, Chile has 7, and has the world’s largest open-pit copper mine – Escondida copper mine, the largest underground copper mine – El Teniente copper mine, with a production capacity of 1.51 million tons and 400,000 tons respectively; Peru has 4, and the production capacity of a single mine is between 300,000 and 500,000 tons. It can be seen that copper resources in South America have an important position in the world. In addition, among the copper mines invested by Chinese enterprises, three of them have entered the top 20 copper mines in the world, namely the Las Bambas copper mine and the Toromocho copper mine in Peru, and the Kamoa-Kakula copper mine in the DR Congo. By the end of 2022, the global copper smelting capacity will be 24.703 million tons. Among them, the production capacity using flash/continuous copper smelting technology was 16.17 million tons, accounting for 65.5%. (See Table 2)

From the perspective of regional distribution, copper smelting capacity in Asia has a clear advantage. Its copper smelting capacity in 2022 is 14.59 million tons, accounting hfor 59.1% of the world; followed by Europe, its copper smelting capacity is 4.207 million tons, accounting for 17%. Asian copper smelting capacity is mainly concentrated in China, Japan, India and South Korea. Among them, China’s copper smelting capacity is 9.14 million tons, accounting for 62.6% in Asia and 37.0% in the world; followed by Japan, with a copper smelting capacity of 1.87 million tons, accounting for 12.8% in Asia. European copper smelting capacity is mainly in Russia, Poland and Germany, with copper smelting capacity of 1.2 million tons, 740,000 tons and 630,000 tons respectively. The copper smelting capacity in South America is mainly distributed in Chile and Peru, with copper smelting capacity of 1.71 million tons and 430,000 tons respectively. Africa’s copper smelting capacity is mainly in Zambia, with a copper smelting capacity of 1.11 million tons. In addition, Congo (Kinshasa) has a rough refining capacity of 180,000 tons. Copper smelting capacity in North America is concentrated in the United States, Canada and Mexico, with a total capacity of 1.43 million tons. In Oceania, only Australia has copper smelters with a production capacity of 550,000 tons.

Outlook

In the next few years, global copper mining capacity and copper smelting capacity will maintain moderate growth. From 2022 to 2026, the average annual compound growth rate of global copper mine production capacity will be 2.8%. Among them, the average annual compound growth rate of copper concentrate is 3%, and the average annual compound growth rate of hydrometallurgy is 1.8%. The average annual compound growth rate of global copper smelting capacity is 3.1%, which is basically the same as that of copper concentrate. From the perspective of capacity utilization, in 2022, the global copper mine capacity utilization rate will be 81%, and the copper smelting capacity utilization rate will be 87% (including processing part of the cold material, and the copper concentrate smelting capacity utilization rate excluding cold material will be 73%).

From 2022 to 2026, the global copper mine production capacity is expected to increase by 3.18 million tons. It mainly comes from Chile and Peru in South America, adding a total of 710,000 tons of copper mine production capacity; Russia in Europe is expected to add 500,000 tons of copper mine production capacity; China, Iran, Mongolia and Uzbekistan in Asia have added a total of 940,000 tons of copper mine production capacity; the DR Congo in Africa is expected to add 580,000 tons of copper mine production capacity. The cumulative new copper mine production capacity of the above-mentioned countries is 2.73 million tons, accounting for 86% of the global new copper mine production capacity. During the same period, global copper smelting capacity is expected to increase by 3.19 million tons. It mainly comes from five countries in Asia, which are China, Indonesia, Saudi Arabia, Iran and Uzbekistan, with a total of 2.87 million tons of new copper smelting capacity, accounting for 90% of the world; Serbia in Europe is expected to add 100,000 tons of new capacity; Copper smelting capacity in the rest of the world remained largely unchanged or increased slightly.

To sum up, in the next few years, the global copper mining capacity and copper smelting capacity will basically show a simultaneous growth trend. Although the copper concentrate processing charges (TC/RC) has increased in the past year, the copper concentrate processing charges is still at a low level relative to the copper price. The main reason is that there are endless voices about the shortage of copper concentrate in the market, and it is attributed to the rapid expansion of copper smelting capacity. Although the copper smelting capacity in Asia will continue to increase substantially in the next few years, there are many uncertainties. For example, there are doubts about whether the new copper smelting capacity planned by China and Iran will be completed on schedule. Therefore, no matter for copper mining enterprises or copper smelting enterprises, in addition to factors such as production technology, production scale and environmental protection, reasonable and balanced profits of upstream and downstream enterprises are also the cornerstone of healthy and sustainable development of the industry.

Reference: Yusheng L. Brief Analysis of Global Copper Mine and Copper Smelting Capacity. China Nonferrous Metals News, 2023-06-08

For your copper EW plant, we, Precision Technology Co., Ltd., will show you EPC proposal and on-site photos from customers, details on www.coppperepc.com, www.anodeplate.com, linda@copperepc.com and daniel@copperepc.com 7*24 service.